With the rapid growth of the seltzer category, it was inevitable that more participants will chase that growth. Using our newest tool, Label Inquiry, we thought we’d take this opportunity to understand how many and what new entrants are making a play at the seltzer space (for this analysis, we included any labels containing Seltzer or Spritzer on the label).

Through October 2020, the TTB approved 349 labels containing either Seltzer or Spritzer, compared to 198 in the entirety of 2019 (+76.3% and with two months to go).

Interestingly, Spirits-based products have seen the largest increase in product approvals, with 150 labels approved YTD October 2020 (vs. 55 in CY2019). Beer-based products received 128 approvals YTD October 2020 (vs. 102 in CY2020) Wine-based products have seen a slight uptick to 71 product approvals (vs. 41 in CY2020). Note: bw166’s Label Inquiry tool is based only on products requiring TTB COLAs so is not fully comprehensive of malt beverages.

Using the color feature from Label Inquiry, we also took a look at the dominant color used on labels. While neutral colors (Black, White, Beige) are generally dominant, the next three most prevalent palettes are Pink, Red, and Lavender. The commonality in color may represent an opportunity for new entrants to distinguish themselves on the shelf further and stand out in consumers’ eyes.

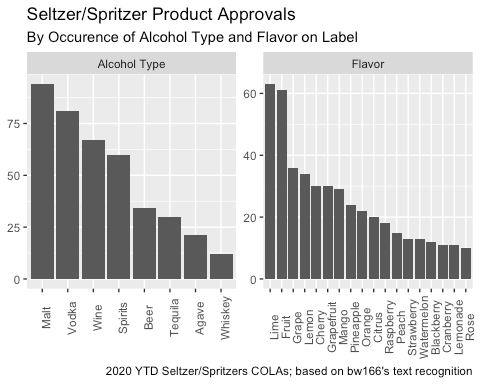

Lastly, we were curious about the breakdown by source alcohol as well as flavor. Malt and Vodka make up the two largest occurrences (followed by Wine, generically). The more interesting finding is the reasonably large share of labels specifying either Tequila or Agave on the label. When looking at flavors, Lime and Fruit are dominant, followed by Grape and Lemon. Intuitively, fruit flavors represent the predominant options. However, there are some more interesting results. For example, Grapefruit and Mango occurring more frequently than Strawberry and Watermelon. This data may ultimately point to a triangulating consumer demand around core flavors or, perhaps more interestingly, represent an opportunity to differentiate one’s product from competitors.

While we can’t predict the exact results of what these increasing product launches will mean; the scale of the category and the diversity of entrants seems reminiscent of the rise in FMB products in the early 2000s following the success of Smirnoff Ice (Would anyone care to admit trying the likes of Captain Morgan Gold, Skyy Blue, or Sauza Diablo?). Only time will tell if any of these new products can unseat White Claw and Truly.

For more details regarding our Label Inquiry application, please visit our Introducing Label Inquiry page.